Algorand Governance Period 4 Whales: Known wallets & Consensus participation statistics

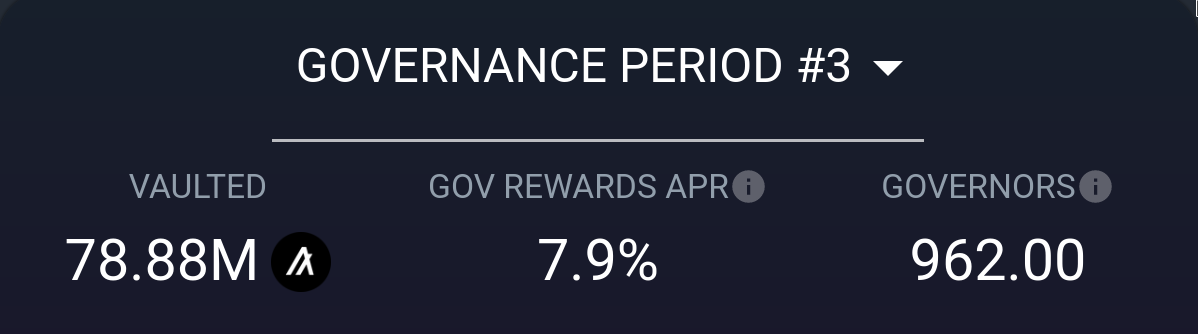

As a follow-up on our report on Voting Power Centralization in Governance Period 4 we decided to look into known addresses from the governor whale list, as well as their consensus participation status. In case you missed it and can't be bothered to check, we defined "whale wallets" as single-entity governors that have committed at least 1 million ALGO and are still eligible. We excluded the top governor - Folks Finance - as their vote is decided by Folks protocol users. ...