TL;DR: Maximizing our vaulted ALGO with borrowed ALGO yielded more than 2x in governance rewards profit.

For the third Governance season we tried the AlgoFi vault for Governance: AlgoFi counts vaulted Algo as collateral that you can borrow against. Borrowing Algo against your vaulted algo has two advantages:

- You can add the borrowed algo to the vault, thus increasing your collateral and ability to borrow more Algo.

- You are not exposed to liquidation danger due to price fluctuations

between your collateral and borrow value, as they are the same

pictureprice.

Your risk in this scheme is essentially confined to smart contract risk: AlgoFi vault contracts failing either catastrophically (entire vaulted amount lost) or partially (inability to vote and/or claim rewards). This was palatable to our risk tolerance considering AlgoFi's reputation and audits, so we tested it out on a few accounts.

The vault-borrow loop allows for increasing your initial amount by more than 2.8x. The borrow utilization percentage that is normally very important to avoid liquidation can be ignored and pushed to the limit.

When calculating performance, we will look at the cost of the loan (and subtract the Aeneas rewards that we collected) and compare the governance profit against participation without loan.

One of our vaults was seeded with 700.49 of our own Algo, against which we borrowed an extra 1300.51 ALGO to end up with a nice round 2000 ALGO committed for governance (we committed 1 ALGO less than our balance for extra safety / superstition). Our initial amount was multiplited by about 2.85x.

On AlgoFi, your interest is added to your borrowed amount. The final borrowed amount was 1314.48 and we collected 4.55 ALGO as rewards from using the platform, making our loan cost 9.43 ALGO for an effective APR of 2.9%.

Our rewards were 39.79 ALGO, for 30.36 ALGO profit.

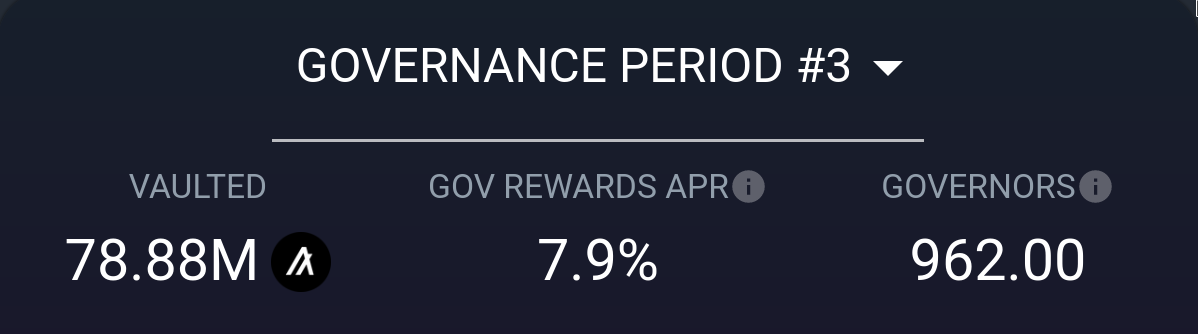

This works out to a period rate of 4.33%, or APR of 17.34% - about 2.18x the "unvaulted" APR of 7.9%

Our other account has slightly better performance - possibly a mistake during data hunting & gathering.

Are we happy with out choice? Yes, we are.

Is it going to be as good for the next period? Probably not:

- The Aeneas rewards were a good (average) 1.4% discount on our loan cost, but that reward percentage has decreased during the period (currently 1.16%). They will also end at some point.

- It is all about effective loan cost APR vs governance APR:

- If all the Algo in the ecosystem participates in Governance this season, the rewards will be tiny.

- If the ALGO borrow cost exceeds governance rewards, you will be worse off for using it.

Are we going to do it again? Yes, we are.