Following a positive response to a reddit post I made about the need for an AlgoFi borrow utilization & liquidation notification service, Hellen and I started looking into AlgoFi blockchain data relating to lending & liquidations. We prepared a nice spreadsheet with every single liquidation, as well as some nice stats.

What's a liquidation?

When you take a loan out on AlgoFi, if your collateral's value drops to be worth less than your maximum allowed borrow value*, your account can be liquidated.

A user liquidates (the "liquidator") another user (the "liquidatee") by repaying up to 50% of the liquidatee's borrow and seizing their collateral at a discount.\

That discount is 7% and is referred to as "liquidation incentive".

* Technically it may also happen due to unpaid accumulated interest, but this would take a long time, and in 2022 crypto space, currency fluctuations - even between stablecoins (cough STBL cough) - are far more likely to kill your collateral than accumulated interest.

Drumroll please

As far as we know, liquidations have been somewhat opaque so far. Based on our interpretation of the data, a handful of addresses perform liquidations but a fair few have happened in AlgoFi lending history (over 2,300 in just over 4 months) and total a fair bit of change (~$1.6M).

We present to you some data insights into the liquidations game of AlgoFi. We have (probably) found and analyzed all liquidations that have happened on AlgoFi. We did this by walking the blockchain backwards from "now" until before AlgoFi was a thing and looking for "type L" transactions - liquidations. We then did it again, this time guided by an indexer to point at specific blocks to look at.

You can find the data at the end of this post in handy spreadsheet if you want to play around with it yourself, but who has time for this nowadays - it's sexy stats time! But first, a sexy disclaimer and a boring explainer:

Stats

Sexy stats time range: From AlgoFi genesis until 20 April 2022

- First liquidation was at block 18043632, which was agreed upon at Wed Dec 15 20:05:46 UTC 2021

- Number of liquidations: 2,307

- Number of liquidators: 19

- Number of liquidatees: 935

- Sum of all liquidations by seized collateral value: ~$1.6M

- Sum of liquidation incentives (7% liquidator profit): ~$113K

- Most successful liquidator by number of liquidations: 2HB66TH3RORMXG4G2F5CIIUA2CDM2DFMNX2P3ZAOBQ3TFXDGUG2KFCDL4Y with 1833 liquidations. By a mile - #2 is at 117 liquidations.

- Most successful liquidator by seized collateral value is, unsurprisingly, the aforementioned 2HB66T..FCDL4Y, with a total of $815K worth of liquidated collateral. The liquidation incentive/profit of which works out to a neat $57K.

- The most expensive single liquidation transaction so far involved paying off 161,915 USDC to seize 176,200 ALGO. Liquidation incentive for that was ~12K ALGO.

- Most liquidated account by number of individual liquidations: WBHJL6KP7LVEOQ6LT47UT7WVWSL3NRR57WUIX2DLVASJQWCRBDQEAGGCD4 with a whopping 79 individual liquidations.

- Most liquidated account by seized collateral value: WBHJL6...AGGCD4 again, with a whopping $412K total collateral seized in today's fiat value. 7% ~= $29K

Who are the liquidators?

"Anyone" can liquidate. It just requires some coding. The AlgoFi lending SDK makes this easy if you have a little bit of programming experience - but you also have to know which account you can liquidate.

In practice you can see that most liquidations happen by a handful of

users, or, more likely, their faithful silicon minions (bots).

Note\ to\ self:\ name\ next\ computer\ silicon-minion

Top liquidators

All 19 of them are 🔝, but some do a bit better than others.

We can see the top 6 liquidators have the lion's share and have made some nice change in exchange for their service to the platform*.

* This is not sarcastic, liquidations of bad loans must happen if you want your lent goETH to supply you with that nice lending APR instead of disappearing into the void that swallows most altcoins. This is DeFi, right? These bad loans are holding users’ assets without full collateral.

Most Liquidated

The liquidatee side of the hall of fame.

MVL

Most value liquidated:

Most common seized collateral by USD value

Seizing assets pays bAssets, which can then be converted into their canonical versions with, you guessed it, some code. Using the AlgoFi Lending SDK you can burn some bALGO into ALGO, bgoETH into goETH, and so on.

Technically all of these should be bSOMETHING - not sure why some

liquidations paid back ALGO instead of bALGO. That's a mystery to be

investigated elsewhen.

Update: Mystery solved by kind redditor /u/adioc here:

This is the result of a recent introduction of vaulted ALGO. vALGO liquidates directly to ALGO.

This tracks with us. First ALGO liquidation was at round 20233268, Tue Apr 5 23:56:15 UTC 2022. Vault went live on March 31st according to this AlgoFi tweet. Hooray for crowdsourced intelligence!

Most common repaid loan asset by USD value

Most Common Liquidation Use Case

Using our extrapolating skills, the last two tables should tell us that the most common liquidation scenario (by almost an order of magnitude) is a user putting up ALGO as collateral to take out stablecoin loans. ALGO price then dips a bit, and the collateral gets a haircut.

The Data

Raw transaction data & various statistics sheets are available here:

Download AlgoFi-Liquidations.xlsx

The spreadsheet above includes a group transaction for each liquidation (column grp_txn). You can search that on AlgoExplorer.io and see the liquidation yourself! E.g. the first liquidation at round 18043632 had group ID YGST8hii9P9OL0SOPqJeaJy2dnhDN21GJQcHr3slsGY= which you can see on allo.info here. It is quite fascinating.

The Service: LiquiFi, NotiFi, NotMeFi or something

Congrats, you reached the advertisement part that is mandatory in all blog posts nowadays (it's the law.)

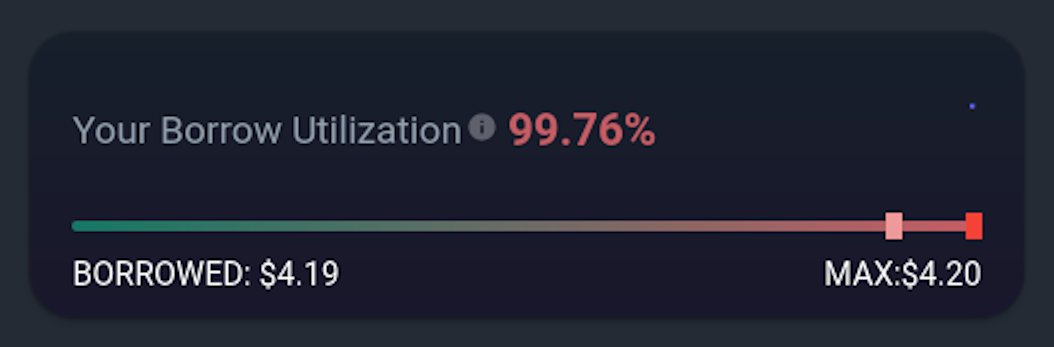

We are building a service that monitors your borrow utilization in real time in order to notify you and hopefully avoid getting liquidated.

As part of our marketing ploy we will likely also include a realtime dashboard of liquidations, if not a searchable interface of all past liquidations. So there's more of this to come, but iinn reeallll tiiimmeeee! 🏎

If you want to suggest your favorite way of getting notified or have any ideas about this, let us know publicly here or privately here. We have started writing up some details about this project here.

If you want to know when we're done building it, you can subscribe to our newsletter for updates - we won't send needless shit, ever. Spam is dead, anyway, nowadays it's all about sending you zero amount transactions with viagra links in the tx note.

Hope you enjoyed reading as much as we enjoyed putting this together.

See you later, liquidater.

- Bit & Hellen